Site navigation

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

0 Results

Start typing to see results...

No results matching your search...

This is the staging version of Municipal Money intended for testing changes and not official information release. Visit the official version at https://municipalmoney.gov.za

Municipal Money is a web-based tool designed to inform citizens on their local authority’s financial performance and allows comparisons between municipalities.

The website is designed to present key municipal financial information to a general audience, who do not necessarily have any financial background or knowledge. This is done by using a variety of visual elements and tools - including interactive maps, charts, graphs and short videos. We have also provided different levels of detail in explaining key financial concepts, so our audience can select the amount and level of information they want access to.

This tool draws on the raw data from the Municipal Money API website – www.treasury.data.gov.za and is a clear example of how that raw data can be utilised to enhance civic education and oversight.

Municipal Money is an initiative of the National Treasury, which has collected extensive municipal financial data over several years and would like to share this information with the public. The aim is to make this data widely available in order to increase transparency, strengthen civic oversight and promote accountability.

The South African system of local government is contingent on active citizens and organised civil society vigilantly exercising oversight and holding their municipalities accountable. Municipal Money aims to promote transparency and citizen engagement through the visualization and ‘demystification’ of information about municipal spending.

In sharing one of its most strategic datasets through Municipal Money, National Treasury is demonstrating its commitment to improving transparency and to the cause of open data.

While there is already a vast amount of municipal financial data available through various sources, the reliability and consistency of that data may be questionable. In addition, the time and effort required to learn where to look for different pieces of information, and how to interpret what is found, may be substantial, and potentially off-putting. Municipal Money empowers financial and non-financial audiences alike, by taking complex amounts of financial and non-financial data, extracting pertinent information, summarizing that information and presenting it in a user-friendly manner.

Municipal Money is an initiative of the National Treasury, which hosts extensive amounts of municipal financial data, submitted by municipalities. In order to share this data with the public, National Treasury has enlisted the help of an external partner, Code for South Africa – an NGO that promotes informed public decision-making using technology.

Municipal Money is a free, impartial, politically neutral, online tool to find out about how municipal funds are spent. Our aim is to help citizens understand where public money is spent and whether this is within acceptable norms, not to comment on how it is spent. In doing so we hope to empower our citizens, strengthen civic oversight and promote accountability. We hope that Municipal Money will be a useful tool for everyone, regardless of their political persuasion and their views on public spending.

A financial year is an organisation’s accounting period of 12 consecutive months, at the end of which the accounting books or records for that period are closed. The financial year is used as a basis for planning, budgeting, measuring financial performance and financial reporting.

The financial year for South African municipalities runs from 1 July of each year to 30 June of the following year. Budgets need to be prepared and approved for each financial year. At the close of the financial year, reporting against the approved or adjusted (if any) budget is required in the form of Annual Financial Statements and an Annual report.

A "quarter" is a 3-month period in a financial year and is often expressed as q1, q2, q3 or q4. A quarter is usually accompanied by the year it relates to. For example, "2016 q1" refers to the first quarter of the 2016 financial year (2015-2016). Since the municipal financial year begins in July of one year and ends in June of the following year, the period being referred to here is July-Sep 2015.

While most of the financial data provided to National Treasury by the municipalities is submitted annually, some data is refreshed and submitted on a quarterly basis. Quarterly updates are important for planning and monitoring purposes and acts as an early warning system. For example, quarterly figures could show that the municipality was not collecting nearly enough of the money owed to it in order to cover its debts. Rather than waiting for annual financial figures to reveal this, the quarterly information allows the municipality to identify a problem and take corrective action sooner.

Audited annual financial statements are the five legislated financial statements that have been prepared, reviewed and determined to be free from error and misstatements.

These financial statements are submitted to the Auditor General to provide reasonable assurance on the financial affairs of the entity.

The financial statements should be fairly presentable and useful to the users and stakeholders to assist in making decisions.

Audited actuals is the set of figures published in the Annual Financial Statements as the financial year being reported on, and which was audited by the Auditor General of South Africa

Restated audited actuals is a revision of the previous year’s audited actuals to make changes to the accounts and to correct errors. e.g. Managers might have misinterpreted the accounting standards, or they simply may have made minor mistakes and need to correct them.

You may use the data freely and flexibly for both commercial and non-commercial purposes.

You may download, copy, publish, distribute and transmit the data. You may also adapt and extract the data.

Your use of the data is subject to some basic Terms of Use.

No. The data is provided free of charge on this website.

You may use the data for commercial purposes, however you may not claim or imply that NT endorses your product, services, analysis or interpretation of the data. NT will not make claims to any intellectual property arising from applications or analysis of the data.

The data on the API is available in an open format, is machine-readable, available in bulk and unprocessed. You may download the data in either Excel or CSV format.

The data is provided at regular intervals by all the individual municipalities in South Africa to National Treasury and housed on their Local Government Database and Reporting System (LGDRS).

No. The data does not identify or provide ways to identify individuals, unless that information is already published (for example, the names of municipal managers and mayors).

When something is listed as ‘Not Available’, one or more of the things needed to show the indicator for that date was missing from National Treasury's local government database. This usually happens when the relevant municipality has not submitted the data to the National Treasury in an acceptable form in time. It might have been submitted late and will be available in the next quarter. It might also be available directly from the municipality but without the vetting done by National Treasury before inclusion in their local government database.

Users should be aware that the data is submitted to National Treasury directly from the individual municipalities and while National Treasury endeavours to ensure that the datasets are complete and validated regularly, ultimately the quality of the data is primarily assured by the Chief Accounting Officer of the municipality.

National Treasury has developed standard indicators and norms based on the Section 71 submissions of municipalities, and these indicators and norms have been used as a basis to compare the financial performance of different municipalities on the Municipal Money website. However, there are occasions when municipal financial performance cannot clearly be classified within these accepted norms and where deviations from the norms are not necessarily a negative reflection on the municipality’s financial performance.

For example, some metropolitan municipalities, with their large populations and substantive budgets, may opt to adopt different strategies of service delivery as compared with their counterparts. This in turn, may involve more outsourcing, less capital expenditure and lower staff costs - all of which, may then fall outside of the generally accepted norms and standards identified by National Treasury.

While we acknowledge these limitations, National Treasury believes that these comparisons are still useful and appropriate as they allow users to identify and explore the differences between municipalities – bringing them closer to understanding the sometimes subtle nuances between municipalities and between categories of municipalities.

To assist users in querying the results of a municipality’s financial indicators, Municipal Money provides a direct email link to the municipal management, where the Municipal Manager and Mayor may respond directly and provide clarification to users.

This level of interest and understanding will no doubt contribute to enhanced civic oversight, greater transparency and increased accountability.

There are three categories of municipalities in South Africa:

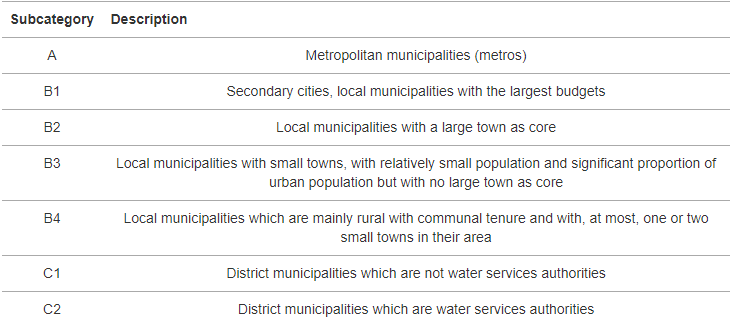

Within these categories, there may be significantly different circumstances between municipalities across the country. Hence, a further set of subcategories have been developed for analytical and statistical purposes. These subcategories have been widely-used in assessments and previous policy initiatives by the Department of Cooperative Governance (DCOG), National Treasury, the Municipal Demarcation Board and others.

For examples of how the subcategories are used, please see:

When referring to similar municipalities, we are then referring to municipalities in the same subcategory as per the table below.

When we calculate an indicator comparison for similar municipalities, we use the median value of the municipalities in the same subcategory.

A mashup is a web page or application created by combining data or functionality from different sources to create a single new service. This new service or functionality usually falls outside of envisaged use of the original applications. Mashups also typically utilize visualisations – pictures that show the data in clear, imaginative ways and tell a story about the underlying information.

For example, a mashup combining data sources such as electoral lists and a mapping tool could show where votes are being cast and for which political parties. This would be of interest to voters and political representatives.

We hope that the data from the Municipal Money API will be used in mashups with other data sources to create innovative, new, interesting and valuable applications for municipal financial data.

Should you come across any inconsistencies in the data or any problematic data on this website that may need to be corrected, please do let us know by contacting us at helpdesk@municipalmoney.gov.za.

If you would like to provide feedback on your experience of using this website and the data contained therein, or if you would like to share with us how you have used the data - please contact us at: feedback@municipalmoney.gov.za.

We will endeavour to respond to all queries and comments as soon as possible.

We realise that you may want to ask us and each other questions and we’ll try and help as best we can. We will be using our Facebook account as a point for discussion.

Should you come across any inconsistencies in the data or any problematic data that may need to be corrected, please do contact us at helpdesk@municipalmoney.gov.za.

You may suggest additional data sets to be uploaded provided it is in the legislative framework in which the National Treasury operates. To do so, please send a request to feedback@municipalmoney.gov.za.

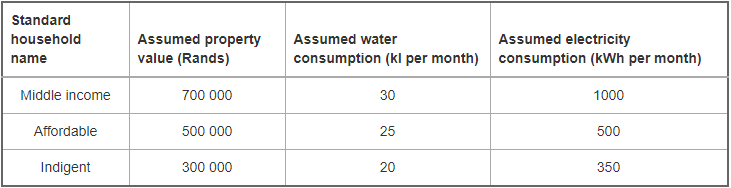

The prescribed Municipal Budget and Reporting Regulations promulgated on 17 April 2009, includes supporting table SA14 which requires that each municipality supply data on household bills based on some generalised statistical parameters. The statistical standards wherein the municipalities must present the application of their tariffs are shown in the following table:

The bills considered are property rates, basic electricity levy, electricity consumption charge, basic water levy, water consumption charge, sanitation, refuse removal and ‘other’.

In these circumstances, specifying ‘standard’ households is a pragmatic approach. It is fine when comparing the bill in a municipality over time. Be careful when comparing these bills between municipalities. The property values, water consumption and electricity consumption of a household in an income category may differ from municipality to municipality. The representative bills shown are useful for tracking the size the household bill in a municipality over time but less useful for comparing the bills between municipalities. The increase is a function of the composition of the bill and the increases in the different elements of the bill..

Some indicators draw from data that is not available in the Data Explorer however this data is available via the API. More details on the API are available here.

These are all the videos used on Municipal Money for learning about monitoring and managing municipal finances. You are welcome to download and share these for you and others to learn from. Please make sure you acknowledge the source of these videos as https://municipalmoney.gov.za.

The Full size videos are the maximum quality but cost more data to download. The Small size videos are made smaller so you can save data and share them on WhatsApp.

Municipal Money is an initiative of the National Treasury, which has collected extensive municipal financial data over several years and would like to share this information with the public.

Please note that Municipal Money is an initiative by the National Treasury to provide information to the public on how their municipality is spending public funds to improve service delivery.

Only queries to feedback@municipalmoney.gov.za that pertain to the information available on the site or technical difficulties to access the information will be responded to. Account related queries must be directed to the relevant department at the respective municipality. Kindly contact the respective municipality directly for such contact details.

The National Treasury do not deal with account related queries and therefore receipt of this email is not acknowledged or recorded.

The rich text element allows you to create and format headings, paragraphs, blockquotes, images, and video all in one place instead of having to add and format them individually. Just double-click and easily create content.

Municipal Money is an initiative of the National Treasury, which hosts extensive amounts of municipal financial data, submitted by municipalities. In order to share this data with the public, National Treasury has enlisted the help of an external partner, Code for South Africa – an NGO that promotes informed public decision-making using technology.

Municipal Money is a free, impartial, politically neutral, online tool to find out about how municipal funds are spent. Our aim is to help citizens understand where public money is spent and whether this is within acceptable norms, not to comment on how it is spent. In doing so we hope to empower our citizens, strengthen civic oversight and promote accountability. We hope that Municipal Money will be a useful tool for everyone, regardless of their political persuasion and their views on public spending.